INFLATION ISN'T THE VILLAIN YOU THINK IT IS

Recently, I came across a video by the Wall Street Journal explaining why China’s deflation is more dangerous than inflation. It was an insightful video, so naturally, I thought the comments would say the same. Turns out, I was wrong. Most comments seemed to see no problem with deflation.

This is what almost every person in the comment section believed. They were like cheers to deflation while tomatoes to inflation. And it made me wonder, do people actually know what deflation means, or are they just looking at a mirage? Naturally. I, being a very talented, sophisticated-minded person (I wish), decided to write about it. So, ladies and gentlemen, here is why inflation is a good thing.

Prices rise. That’s the universal truth. And a lot of people don’t like it, which makes sense when you think about it. Knowing that you’re buying a good that would be more expensive as time passes? Yea. Not really fun. But here’s why inflation is actually a good thing when it's in control.

Inflation equals a price increase. That $500 laptop you bought today? By next year, it would probably be $510. Not because suddenly it has become really popular, but because of inflation. This pisses people off. “So I’m paying $10 extra for nothing?!” That’s the thought process that goes behind it. But here’s the good part. Inflation, when it's in control, is accompanied by an increase in wages.

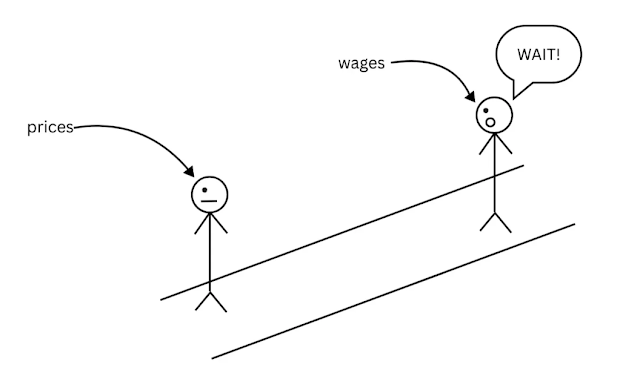

So rather than this:

It's more like this:

Because obviously when prices rise, employees need more money to spend (they need to pay those bills), so their wages rise, they spend, and in a chain reaction, companies earn more money.

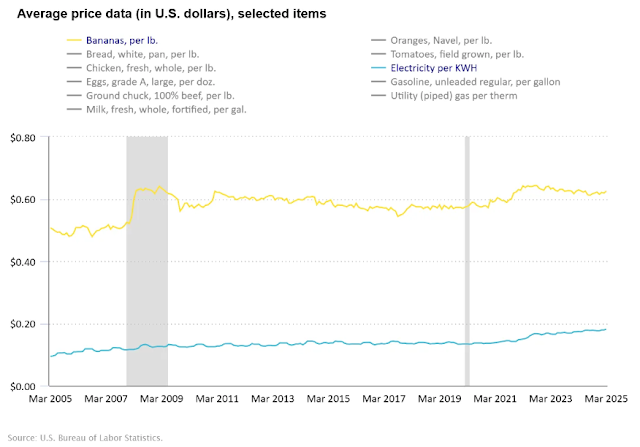

Now, around 2% inflation = a good and healthy economy. It shows that there is demand and growth. Keep in mind that only GRADUAL inflation is good. That drastic spike and plunge, those are UGLY. Take this piece of data from the US Bureau of Labor Statistics, for example.

This is the average price data for the past two decades. In case you were wondering, those areas with the grey background show a recession. Notice that massive drop in 2008? And the comparatively-less-but-still-very-significant drop in 2020? Yeah, that’s the 2008 recession and the pandemic recession, respectively. Now, this looks really messy but if you look closely (by which I mean squint the way you do when your sibling turns on the light in your room just as you’re about to fall asleep) you’d notice that most of items have this small upward slope in their graph, proving my point that prices constantly and gradually rise. But….there are also some others, like the graph for gasoline, which looks like a whole rollercoaster.

Absolutely no pattern. It's like a bunch of random peaks and drops.

And then some look like straight up flat lines (bananas and electricity)

Explanation? The price of bananas hardly changes in the US, they’re mostly imported from countries where they are mass-produced at a low cost. They’re grown year-round and easy to ship. And the graph for electricity only looks like a flat line when it's compared to other items, but when selected individually….

Yea. Clearly NOT a flat line.

In short, there is an upward trend in prices.

But what happens when there is a sudden peak or drop in prices, i.e, excessive inflation or deflation? The central bank steps in. Say there is crazy deflation, the first thing that the central bank is gonna do is lower interest rates. Why so? Because if people are charged less interest, they would be willing to take loans and buy stuff, which means more demand. Similarly, in case there is crazy inflation, the central bank would increase the interest rates so that people buy less, which slows down the demand, and companies are forced to lower their prices. And I know it seems crazy because imagine not being able to afford your damn groceries and here intervenes the Fed like ‘guess what? Loans gonna be difficult too’ but that’s what they gotta do to avoid plunging into a recession.

In short: EVERY YEAR PRICES HAVE TO RISE A LITTLE (ALONG WITH WAGES, because they go hand in hand like two peas in a pod)

A question that might arise is that if they do go hand in hand, why keep increasing? Like you know what, just don’t change either. No inflation and no change in wages. And that might seem like a good idea in theory, and only in theory. I’ll give a couple of reasons why it's not a good idea:

- Lack of demand:

See, right now if you want to purchase a car, you’ll be like ‘okay lemme buy it right now instead of delaying because next year it's going to be a little more pricy’. BUT, if people KNOW for a fact that prices are gonna stay constant, they’re gonna be like ‘meh, lemme just buy that car next year’ because it's not like it's gonna cost more. So, unless something is urgently needed, people won't bother buying it. That’s gonna slow down demand and ultimately the overall economy.

2. No increase in wages.

In theory, it might seem that if people can afford a good standard of living with the wages they currently have, then they won't want a higher wage. Except it's not. Because that would just piss off people. Imagine working at a place for years, but you’ve never gotten a salary raise. Obviously, that’s not gonna be fun. But your company can't afford to raise your salary because they don’t earn that much. And they don’t earn much because the prices are constant. But say if they increase the price a tiny bit, then they can afford to increase their workers' wages or something else, like upgrade some stuff, open a new branch, get renovations done, or something like that, which means more room for business, and more room for money.

And then there is this very interesting situation called a liquidity trap. Sounds complex, I know, but hear me out on this one because it's very interesting.

A liquidity trap is a situation where inflation is either negative or super low. The economy is slow as a sloth, and people aren’t buying (not cause they broke but because they believe that prices would go down further and/or never really change, so what’s the hurry in buying). The central bank/government is DESPERATE to wake up the economy. They would lower the interest rate in hopes that people would borrow some money and spend it. But it still doesn’t work. THAT is a liquidity trap. Prime example? Japan during the 1990s. Ever heard of The Lost Decade? It was a liquidity trap.

By now, I’m assuming (by which I mean hoping and praying) that you see why deflation isn’t really what it sounds like. It's like a mirage. Most people look at it from afar and assume it's a good thing, when in reality, it's not. So, unless you want to go broke, don’t hope for deflation

.

Thank you for taking some time off to read the 1089 words so far (unless you are broke or unemployed, in which case you better read my blog because the only thing worse than being broke is being broke and having zero economic knowledge)

.png)